Sidebar

Analyst/Editor

Vin Maru is an editor for Invest In MJ, Tech Investor Report, Golden Fortunes and TDV Golden Trader.

Cannabis In Canada Market Overview October 2016

Canadian Market Overview

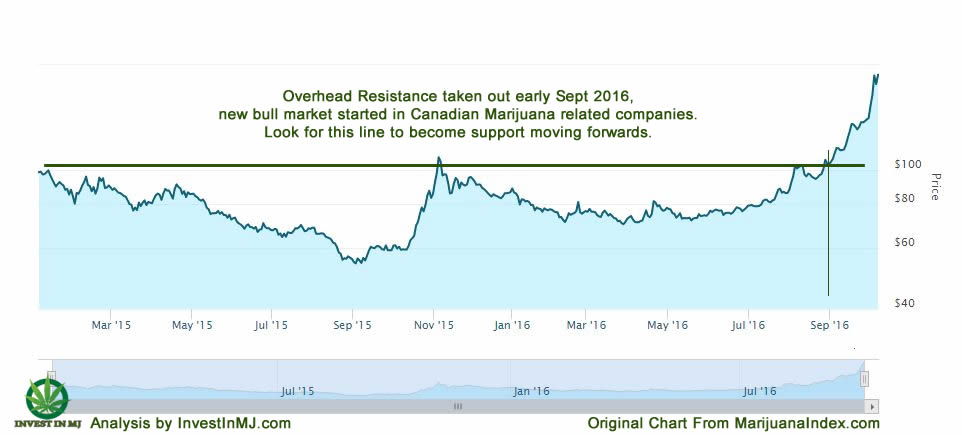

The Canadian cannabis sector continues to be blazing hot over the last year, especially in the last 2 months. The following chart shows the performance of the Canadian marijuana sector in general, the Marijuana Index Canada contains a list of 10 publicly traded Canadian companies in the space, their stock prices and market caps. Just looking at this chart, there has been a parabolic rise in share price since May of this year. Most parabolic rises like this are usually followed by a correction and then a basing period before any further advances can be made. The chart does show a clear break out and passed overhead resistance, this means we are in a new bull market for cannabis stocks in Canada. We will provide an update on the American cannabis sector shortly.

Currently licensed producers can only sell medical cannabis to registered patients of which there is about 82,000 of them. That may seem like a small number of patient for 35 licensed producers to sell to, however the Canadian marijuana landscape is about to change in 2017. Canada’s government is in the process of allowing recreational marijuana across the country next year, so the number of customers these licensed producers can sell to should increase significantly by multiple folds in 2017 and 2018. The recent rise in share prices of the publically traded companies in Canada is a result of anticipation for the recreational market opening up and their sales to increase over the next few years.

The stock prices of these companies may continue to rise in the short term, however any correction into the fall and in December should be bought as we are very bullish on the MJ sector for the remainder of this year and over the next 2 – 5 years, this is just the beginning of the next major advance that the sector and stocks will make.

Companies like Organigram had a $143M market cap in Aug when it traded up to $1.85, their stock price recently reach all-time highs on October 10 with a share price of $2.53 giving it a market cap of about $201M. Canopy Growth Corp. (Tweed) with a market cap that reached $440M during August 2016 has seen their share price rise significantly over the last few months and is trading at all-time highs at $5.58 with a market cap over $645M. You can see real price charts like the ones below on many of the companies in the cannabis industry which are growers from the directory listing.

As of October 17, 2016 here are the companies in Canada listed in the MJ index, their current share price and market cap.

Name Symbol Price Market Cap

Aphria Inc APH:CA 3.630 345.43m

Aurora Cannabis Inc. ACB:CNX 1.62

Canopy Growth Corporation CGC:CA 5.840 675.37m

Golden Leaf Holdings Ltd. GLH:CNX 0.690 65.80m

Maple Leaf Green World Inc MGW:CA 0.810 94.35m

Mettrum Health Corp MT:CA 3.750 175.74

OrganiGram Holdings Inc OGI:CA 2.480 210.29m

PharmaCan Capital Corp MJN:CA 1.180 142.28m

Supreme Pharmaceuticals Inc. SL:CNX 1.290 199.61m

THC Biomed Intl Ltd THC:CNX 1.280 128.97m

I suspect their share price could come down over the next few months and probably into tax selling season in December. If you have made any good profits in the last year with any of the publicly traded cannabis companies in Canada, you may want to take some money off the table and look to buy back into the sector after a correction and pullback if you are looking to trade them. If you are a long time investor, buy them on any dips and hold them for the next few years.

There is a chance some of the stock prices may continue to rise if the market is adding expectation about the recreational market opening up in 2017; however that expectation and rise should come after a much needed correction and base building. But given the excitement around the sectors, investors are still buying so there could very well be no correction or just shallow ones. Once the correction is over, I am expecting a significant rise in 2017 for Canadian licensed producers as it looks like Canada will be opening up the recreational market next year. If this happens, we can expect significant sales increases for these LP and with that a surge in share price.

Finding Value In A Canadian Licensed Producer

While many of the publicly traded companies in Canada have seen their stock price rise significantly in the last few months, we question how much value is left for an investor. At Invest In MJ, we look for companies which have tremendous value and upside. One of the companies we have written about in the past is Emblem Corp. They are a private company that will be going public next month, so you may want to look at their shares once they start trading (expected date is November 14th).

The company just recently announced a financing that will be closing at the end of this month.

Looking at the comparables, the company is still undervalued to the other publicly traded Canadian licensed producers. Its peers are trading 2 to 5 times more than Emblem’s valuation post financing. There is the potential for their share price to rise significantly over the next year and get a similar market cap as its pears.

As for downside risk, there probably is not much at this point unless they lose their license, but the chance of that happening is very slim to none. The current shares out are very tightly held by management and insiders, they have a hold on them so not many shares will be in the public float at the time of listing. With such a tightly held share structure, whatever free trading shares become available should command a much higher price than this offering. The shares from this offering should become free trading in the spring of 2017, which is the expected time frame when Canada should have a guideline for the recreational market.

If you are interested in learning more about Emblem and would like a free report and our coverage on the company, please contact us at info@invesetinmj.com. If you are interested in participating in this private placement contact us or Danny Brody from Emblem investor relations dannybrody@emblemcorp.com.

Watch our recent interview with Peter Clough from EarlyInvesting.com, we discuss the outlook for the cannabis industry with a focus on the Canadian market and opportunities. To learn more about investing in the marijuana industry, please visit our site and sign up for our newsletter.

Comments

-

Please login first in order for you to submit comments