Nov 11, 2017 at 14:00

Charles Alovisetti is a senior associate and co-chair of the corporate department at Vicente Sederberg LLC, and works with legal cannabis businesses in the U.S.

In this opinion piece, Alovisetti warns such enterprises to be wary of using bitcoin or other cryptocurrencies as a solution to the pot industry's continued difficulty obtaining or keeping bank accounts (a familiar problem for blockchain startups.)

One of the major challenges facing legal marijuana businesses is lack of consistent access to banking services. Many marijuana businesses do have banking accounts, but the sword of Damocles dangles above them, always threatening an unappealable termination of an account.

Enter digital currencies, which promise an end run around a wary financial system. There is a great deal of excitement in the marijuana industry about the possibilities regarding bitcoin and other cryptocurrencies.

But before the cannabis industry gets carried away with images of marijuana businesses sidestepping hostile federal banking regulators, we need to take a hard look at the future of digital currencies.

Alternative prescriptions

One strategy that's been pushed is for cannabis businesses to take an existing digital currency and simply use it as a method of transacting business to avoid the need to rely on banks.

This way, marijuana companies without bank accounts could eliminate the need to operate in cash, instead accepting payment directly from customers or other businesses in digital currency – although converting digital currency into dollars will still require a bank account.

Another possible use of digital currencies would be to develop a new token, often referred to as an app coin, protocol token, or altcoin, specifically for the marijuana industry. Again, the goal would be to reduce or eliminate the use of cash and integrate blockchain technology into the compliance and other needs of marijuana businesses.

Finally, some business offer bitcoin-based payment processing services. These services allow customers to purchase bitcoin via a credit or debit card and then purchase a marijuana product with the recently acquired bitcoin. The store then converts the bitcoin back into dollars. The idea is to provide an alternative to traditional payment processing services and credit card companies that will not work with marijuana businesses.

Harsh realities

However, regulators present a real and present threat to cryptocurrencies as they currently exist; for example, recent Chinese regulatory restrictions have seen the closure of platforms allowing people to buy or sell tokens.

And these threats become even more important for digital currencies servicing marijuana-related businesses ("MRBs" in the parlance of the Financial Crimes Enforcement Network of the U.S. Department of the Treasury, or FinCEN).

As longtime CoinDesk readers will recall, in March 2013, FinCEN published its initial guidance on virtual currencies. The agency defined three categories of participants: users, exchangers and administrators. A user is "a person that obtains virtual currency to purchase goods or services," whereas an exchanger is "a person engaged as a business in the exchange of virtual currency for real currency, funds, or other virtual currency" and an administrator is "a person engaged as a business in issuing (putting into circulation) a virtual currency, and who has the authority to redeem (to withdraw from circulation) such virtual currency."

FinCEN concluded that, barring any specific exemption, exchangers and administrators are money service businesses (MSBs) and as such are subject to FinCEN registration and the framework of the Bank Secrecy Act (BSA), which was designed to aid FinCEN's investigations of potential criminal activity.

Subsequent administrative rulings have clarified that FinCEN considers digital currency exchanges, ATM operators, and payment processors to be exchangers within the agency's tripartite framework.

On the marijuana side of the equation, it is important to note that, while marijuana remains illegal federally, the industry in the U.S. exists in its current form because it is tolerated pursuant to federal policy, as set forth in the Cole Memo (put out by the Department of Justice on Aug. 29, 2013).

The Cole Memo states that while marijuana remains illegal federally, federal law enforcement should not consider prosecution of state-legal marijuana businesses if those business do not implicate any of eight enumerated enforcement priorities (e.g. preventing revenue from the sale of marijuana from going to criminal enterprises and preventing state-authorized marijuana activity from being used as a cover or pretext for the trafficking of other illegal drugs or illegal activity).

A potent brew

While it is unfair to associate all digital currency use with illicit activity, there is a perception, reinforced by certain bad actors, that digital currencies are being used to launder money, divert revenue to criminal enterprises and traffic illicit drugs. Any risk that a business could be seen as violating the Cole Memo priorities needs to be treated extremely seriously as it could provoke a federal law enforcement action.

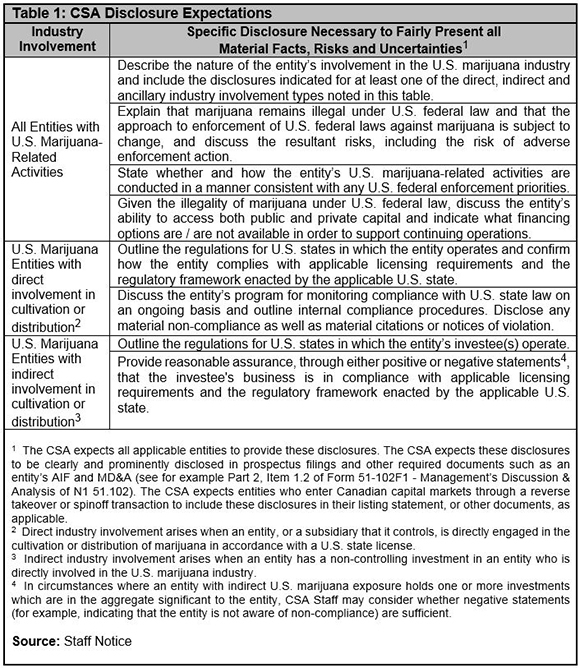

While the Cole Memo addressed violations of the Controlled Substances Act (CSA), it was silent as to financial crimes that would inevitably result from the use or banking of proceeds of a federally illegal activity. In response to financial institutions' concerns regarding accepting MRBs as clients, on Feb. 14, 2014, in two memos often referred to as the "Valentine's Day Letters," the Department of Justice and FinCEN each outlined their respective attitudes to money laundering concerns related to the violations of the CSA.

The FinCEN memo contained detailed guidelines on how to provide banking services to an MRB while remaining compliant with the BSA. These guidelines included the obligation to file different types of suspicious activity reports (SARs) in response to activity on the part of an MRB. The new DOJ memo updated the earlier Cole Memo to extend the realm of non-priority violations to include provisions of the money laundering statutes, the unlicensed money remitter statute and the BSA triggered by underlying violations of the CSA.

But the DOJ reiterated that any exercise of discretion regarding its resources was subject to the provision of services to an MRB whose activities do not trigger any of the eight priority factors. The DOJ also noted that following the FinCEN guidance was critical to remaining within the low enforcement priority category of the Cole Memo.

Again, FinCEN has also made it clear BSA compliance obligations also apply to many businesses dealing in digital currencies – exchanges, ATM operators and payment processors are all required to register as MSBs. That means that to comply with the Cole Memo and FinCEN's marijuana policy guidance, any digital currency business that is required to register as an MSB must make the required SAR reports outlined in the Feb. 14, 2014, FinCEN guidance.

Just say no

When it comes to marijuana firms using cryptocurrencies, discretion should remain the better part of valor.

The marijuana industry in the U.S. exists solely due to permissive federal policies that require businesses to follow certain guidelines, including filings SARs with FinCEN. If these guidelines are not being followed to the letter, which is a challenging and sometimes onerous task, a business is no longer within the guidance of the Cole Memo and is at higher risk of facing federal law enforcement action.

And even if these guidelines are religiously adhered to, while FinCEN-compliant use of digital currencies is not explicitly prohibited by federal policy, their use is sometimes linked by law enforcement with money laundering, illicit drug sales and other illegal activities.

As these crimes are listed as prevention priorities in the Cole Memo, digital currency use could potentially provide an excuse for Attorney General Jeff Sessions (no fan of legal marijuana) to crack down on state-legal pot enterprises.

Original Article: https://www.coindesk.com/pipe-dreams-bitcoin-wont-solve-pot-industrys-banking-problem/