Editors Notes: This is exciting news to see a major bank in Canada finally participate in the Cannabis industry and start financing larger cannabis licensed producers, the fact that Canopy has a $7 Billion dollar market cap and now big banks are investing in the space gives credibility to the Canadian cannabis sector.

Original Article:

Bank of Montreal became the first major Canadian bank to lead an equity financing for a public company in the medical marijuana sector, underwriting a $175-million stock sale for Canopy Growth Corp.

The bank's capital-markets arm and GMP Capital Inc. will be the co-lead underwriters on the bought deal financing, which was announced after the markets closed Wednesday. The deal was done at a price of $34.60 per share, or 8 percent below the company's closing share price on Wednesday.

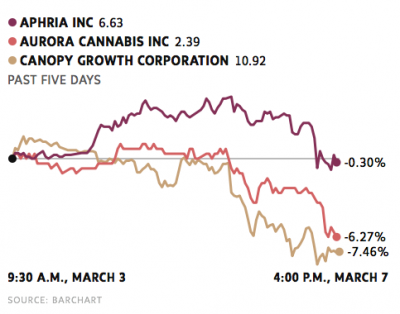

Pot stocks have whipsawed in recent weeks, climbing sharply at the start of 2018 before selling off amid concerns about regulatory changes in the United States. Canopy, the largest Canadian public company in the cannabis sector with a market capitalization of $7.2-billion, has seen its shares climb 26 percent since the start of the year – yet they have fallen more than 10 percent since Jan. 9.

Canada's big banks have been hesitant to get involved in a visible way in the burgeoning marijuana sector because they have significant operations in the United States, where there is considerable conflict and uncertainty surrounding marijuana laws. The drug is legal in many U.S. states, at least for medical use, and on Jan. 1 California became the largest state to legalize it for recreational use for adults. Yet it is still illegal under U.S. federal law.

Since Canopy is one of the Canadian-headquartered cannabis companies that has no operations in the United States, it is considered a safer one for banks to do business with.

BMO was "very grueling about the fact that they are not looking to work with companies that break American law," said Bruce Linton, chief executive officer at Canopy.

Canopy's size and inclusion in the S&P/TSX composite index also means that it has a broader following among institutional investors.

"I think this signals a new normal," Mr. Linton added, referring to BMO entering the sector. "What I think is going to happen is the institutional buyers who've said we don't really do this because banks don't do this are going to say 'shoot, we really should do this.'"

Canopy is raising funds at a particularly tumultuous moment for the industry.

Days ago, U.S. Attorney-General Jeff Sessions revoked Obama-era guidelines, referred to as the Cole Memo, that limited how federal prosecutors could investigate and prosecute state-licensed marijuana production and distribution.

At the same time, the Canadian Securities Administrators (CSA) has said it is rethinking existing rules that allow marijuana firms with U.S. operations to go public on the stock market and raise money in Canada, as long as they disclose the legal risks they face south of the border.

Bank of Montreal has a relatively new CEO -- 46-year-old Darryl White took the top job last November -- who is a former investment banker. The bank has an extensive retail network in the U.S., along with significant U.S. capital markets operations. However, this deal doesn't indicate that the bank would be willing to support deals with cross-border cannabis companies.

Executives at Canada's other bank-owned investment dealers are expected to re-visit their policies on taking part in cannabis financings in the wake of BMO's participation in the Canopy Growth offering. An executive at a rival bank said late Wednesday: "We are reviewing our interpretation of the rules as we speak, and I imagine every other bank is doing the same."

The deal comes amid a hot market for financings related to marijuana stocks. Already, the amount raised in equity deals since the start of 2018 is closing in on $700-million in Canada. Until now, deals have largely been led by independent investment dealers such as GMP Capital Inc., Canaccord Genuity Group Inc. and Eight Capital, with the capital-markets arms of the Big Six banks on the sidelines.

Blog Repost: View Original Article