Sidebar

Analyst/Editor

Vin Maru is an editor for Invest In MJ, Tech Investor Report, Golden Fortunes and TDV Golden Trader.

How Accredited Investors Should Follow The Marijuana Trend

This is an exciting time to be an accredited investor in the medical marijuana / cannabis sector, the industry has become legalized in many countries around the world and that trend is only gaining momentum. To be successful at investing, most sophisticated investors like to follow trends and get invested early while the trend is gaining momentum. Once you have maximum participation from the retail investing crowd, we can be assured the trend for that sector had pretty much peaked and will soon reverse.

While the last year has been an extreme roller coaster ride for most investors in the cannabis market, we can feel confident that this trend is still at the early stages, well established and on an upward momentum. The rise and fall in stock prices in the last year was a result of hot money coming in and out of the sector, illiquid markets and tight share structures. But what we didn't see during that time is the participation from the institutional and professional money crowd.

The Trend For Investing In The Marijuana Sector Is Now About To change.

Over the last six months, we have seen participation by professional money managers, the brokerage companies and accredited investors. These investors usually don’t buy stocks in the open like most retail investors do. Remember they are sophisticated when it comes to investing and they understand the best way to get invested in a longer trend, which is usually via private placements. The professional money managers know to get invested with the best companies at the earlier stages where financing is needed and they can acquire big blocks of shares via private placements and bought deals.

They usually stay invested for the longer haul with a 3 to 5 year time horizon where they can maximize their profits and sell shares to the retail investor at the peak of the sector trend. Knowing their investment timeline and exit strategy can help the average investor piggy back on the professional’s strategy for investing within a larger trend. Since the professional money is now entering the market, we can be assured that the investment trend in the marijuana sector still has another 3 to 5 years to go. The trend for investing in the cannabis sector is gaining momentum, but we are still at the early stages and now is the best time to be an investor in this space as we still have tremendous upside over the next few years.

While most retail investors do not have access to private placement deals, there is an investor class that can benefit from the larger trend and get invested alongside the professional money managers, they are called Accredited Investors. This essentially means you have a net worth of over one million dollars or several hundred thousand dollars of income each year. To see if you qualify to get access to the best private placement deals in the marijuana industry, you can view the accredited investor guidelines for both US and Canadian residents.

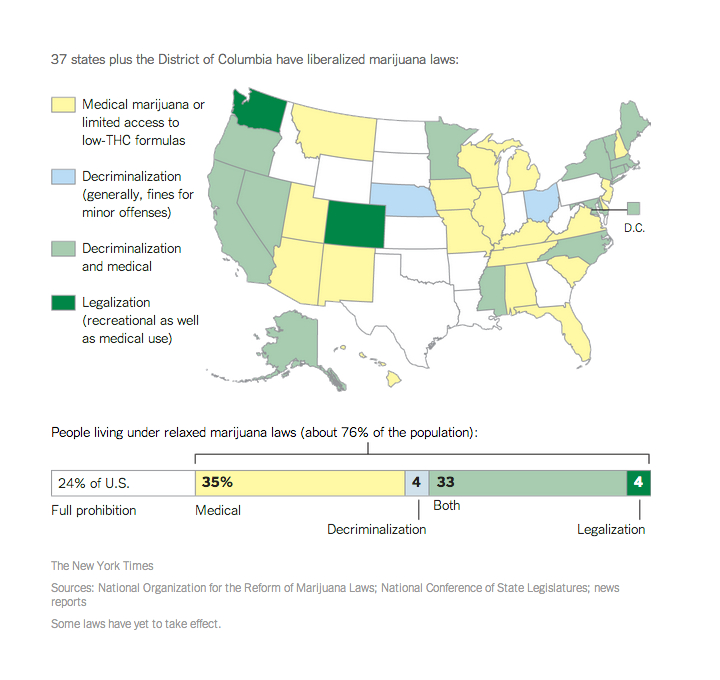

If you qualify as an accredited investor, you should take the opportunity to evaluate these private placements while they are available during the early stages of financing required by these companies. The big fund managers are just starting to enter the marijuana industry, but at the moment many are reluctant to invest in private placements because of the lack of uncertainty around rules and regulation created by the U.S Federal Government. As the trend for legalization in many States continues to gain momentum, we can expect the US Federal Government to cave in and stop The War Against A Plant, especially since over 50% of the population thinks that marijuana use should be decriminalized.

Once the really big fund managers, who are still sitting on the sidelines, are given the green light to start investing in this sector, these early investors will benefit from the sectors growth and the share prices will rise from the additional buying pressure. Once that happens, the market caps will also rise to a point where the institutional fund managers will be in a position to start getting invested in the marijuana sector. At the moment, many of the institutional money can’t get invested in companies with a small market cap, but as the market caps start to rise, we can expect these fund managers will have to pay a higher premium for the industry leaders in the MJ space.

Finding The Right Private Placement Deal

At this moment in time, they key to investing in the MJ space is to identify several different companies which standout above the rest, get invested early enough (especially now that many of the company’s stock price have corrected) and then wait for the broker and institutional money to start aggressively buying the sector.

Accredited Investors in Canada and the United States have an amazing opportunity to get invested alongside some of the professionals who are early adaptors and visionaries; they see where the marijuana sector is heading and they are placing their bets on some potential leaders.

The trend for sector is already established and it is gaining momentum, over the next year or two we can expect to see some companies with great potential raise capital via private placements. As an accredited investor, you want to get positioned early enough in some of the best companies and ride the trend. Your strategy should be to identify the the best MJ companies who are raising capital now, get invested and sell to the institutional money manager or the retail investor at the peak of the trend when excitement is at its maximum.

#InvestInMJ has already identified several private placement opportunities for accredited investors to participate in and we are evaluating dozens more. We only select the best opportunities with private and public looking for financing and share them with our audience. If you qualify as an accredited investor and would like get more details on the best deals, you may want to subscribe to our MJ Accredited Investor News letter.

The latest company we introduced accredited investors to was Organigram Inc., a licensed producer under Health Canada's MMPR Marihuana for Medical Purposes Regulations. The company’s private placement opportunity was oversubscribed and is now closed. The company expects to be trading on the TSXV by the end of this month on Aug. 25th under the symbol OGI. Organigram Inc was recently in the news, here is the link.

http://globalnews.ca/news/1485353/monctons-medicinal-marijuana-company-plans-further-expansion/

Since the company already has a license and will be generating cash flow at the end of this month, we think it is de-risked in terms of an investment, which is why we were excited to get involved in bringing it to accredited investors.

While the opportunities and options for accredited investors to get involved is probably the best way to play the larger 3-5 year trend in the MJ space, the retail investor can also benefit from this trend and get invested at an early enough stage. I write a subscriber based newsletter for TDV which provides a general overview of the marijuana industry and provides coverage on some of the best companies in the space. We provide ideas for buy and hold, as well as trading strategies on many of the companies we feel have the best chance of success to become an industry leader. You can get more details and subscribe at TDV Golden Trader.

Remember, any investment does come with some risk. We are not professional financial advisors; please consult your financial advisor before making any investments decisions, including any of the marijuana related private placement investment opportunities presented on our site. Please read our Legal Disclaimer before making any investment decisions on any of the companies we provide coverage on.

Comments

-

Please login first in order for you to submit comments