Sidebar

Invest In MJ Blog Reposts

Invest In MJ Blog Reposts are articles and blog posts written by other authors which relate to the marijuana, cannabis and hemp industry.

Alan Brochstein talks about Medical Marijuana, Inc. (MJNA)

This blog post was written by Alan Brochstein and the original post can be seen here.

In typical fashion for the company, Medical Marijuana, Inc. (MJNA) dropped an aggressive press release lacking substance in what appears to be a last-ditch effort to interest investors in its comatose stock. Before the market opened on 1/22/15, the company announced that it had signed a "Definitive Agreement to Acquire Kannaway, LLC", a newly formed multilevel marketing organization (MLM) that is owned by General Hemp, LLC. General Hemp is controlled by Stuart Titus, who has long ties to MJNA and was able to pull out $7mm from CannaVest (CANV) as he sold into the speculative peak last year as described by Forbes Magazine and detailed in SEC filings.

The press release described the products, shared some information about the company's success, and trumpeted a valuation by Houlihan Capital of "$119.6-242.7 million". That sounds huge considering MJNA itself is valued by the market at roughly $120mm based upon about 1 billion shares and a recent close near $0.12. In my view, it's what MJNA didn't say that should leave investors concerned:

- What are the terms of the "definitive agreement"?

- What are the financials of Kannaway?

- How will the acquisition benefit MJNA shareholders?

What's the deal?

The press releases describes the deal as "definitive" but leaves shareholders guessing about the price or the structure. These are basic elements to any deal! The structure is pretty easy to guess - it is likely to be shares, as MJNA has little cash and no known credit line. So, expect the company to pay with stock.

How much will they pay? This is unknown, but I would assume that it is a big discount to the valuation and will go with an arbitrary value of $60mm, which would be about 1/3 of the current market cap of the company on a combined basis. At .12 per share, this would mean that MJNA would issue 500mm shares.

To the extent it is less and the valuation is truly in the range that the company suggests, it could be a good deal, while to the extent MJNA is paying more, it could be a very costly transaction. Again, because the company provided no guidance, investors are left to guess.

How is Kannaway doing?

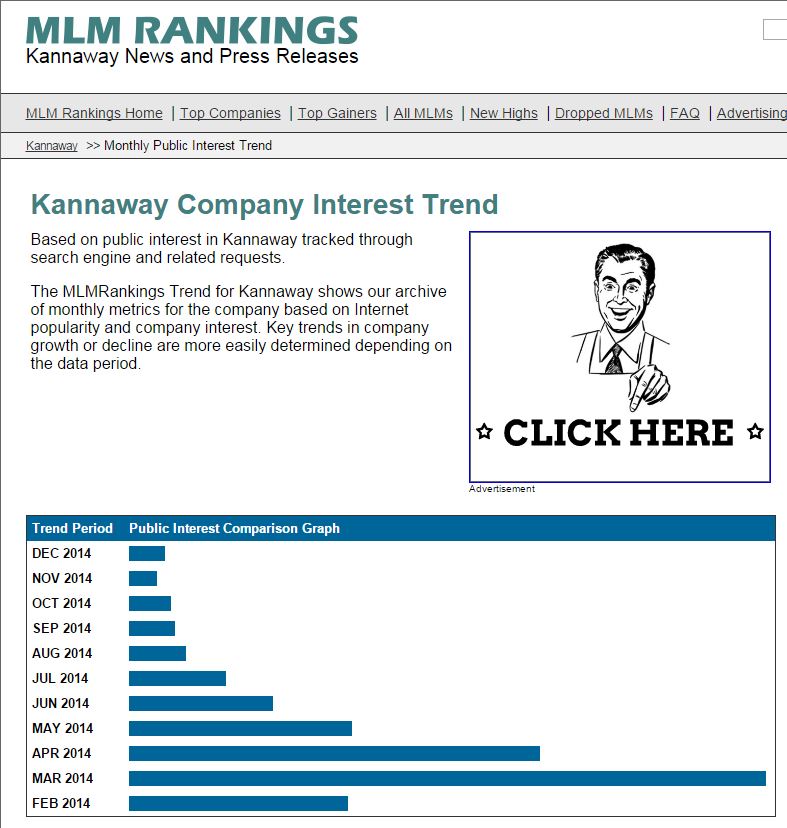

The press release points to some very old news about Kannaway's launch but doesn't give any indication of current financials or projections. While having an appraisal is interesting, the Houlihan Capital valuation isn't explained in any manner. Without being able to see the analysis, investors should not give it too much merit in my view. If Kannaway were doing well, it would be continuing to share details as it did in its early days (and as was repeated in the press release. According to this analysis from MLM Rankings, the buzz is gone:

There are so many things the company could have shared that would help investors make an assessment, including financial details or even the number of active "brand ambassadors" and some context about the growth in that figure. Instead, investors are left to guess, and I am going to guess "not so great" due to the company's failure to discuss it.

Why do the deal?

Anytime a company does a deal, it should be clear why it is doing so. Specifically, how does the deal improve the company? In this case, there is no specific rationale provided. This is what COO and Chairman Michelle Sides said:

"We are thrilled at the addition of Kannaway to Medical Marijuana, Inc.'s investment portfolio as the Company's leadership operates under the same beliefs. Kannaway offers Medical Marijuana, Inc. shareholders a unique, built-in educational and distribution network comprised of tens of thousands of Kannaway's Brand Ambassadors. Together we look forward to writing a new chapter in global hemp history."

I thought that MJNA was ALREADY benefiting from this distribution network. How does owning it help? It is certainly not clear from the press release.

Why just a small bounce?

For such big news, the reaction was rather unimpressive:

The stock rallied on increased volume, but it was unable to clear 0.13 resistance. Notably, the volume, while higher at 7.9mm shares, was substantially lower than the pre-election moves and the end-of-year trading, when it spiked to about 20mm shares in both periods.

I can't blame investors for not biting. It was just two years ago that MJNA tried to pull a fast one its investors when it shared financial projections:

Corporate Revenue Guidance for 2013-2014

The company is pleased to issue its first ever Sales Guidance and Outlook for 2013-2014. The company forecasts revenue for 2013 to be $47,000,000 with operating cash flows of $32,000,000 and has the potential to increase revenues in 2014 to $155,000,000 with operating cash flows of approximately $95,000,000.

2013 results were not even close, with the company reporting sales of about $5mm and operating cash flow of $2.1mm (see supplemental cash flow statement). While we have only 3 quarters of 2014, it is clear that the call for $155mm in revenue will miss by more than $135mm, as the company has reported only $12.3mm in sales so far and the last quarter was a decline from the prior quarter. Operating cash flow has been slightly negative through the first three quarters, far short of the $95mm that the company projected. Given that there was no mention of financials at all in their recent year-end report press release, it is probably safe to assume that the financials weren't worth trumpeting.

Another issue is that investors know that MJNA doesn't typically disclose bad news in a timely manner. For instance, it has had several court battles (Dixie, CannaVest) that were not disclosed by the company in a timely manner. Of course, as a non-reporting Pink Sheet company, MJNA is under no legal obligation to do so. It took an article by Seeking Alpha Contributor "Rolling O Research" to expose a recent judgment that resulted in the company having to issue 45mm shares to Roen Ventures (Bart Mackay), and this has led not only to more mistrust of the company but also likely pressure on the stock as Mackay has potentially been liquidating.

Conclusion

When a penny stock announces a deal with limited details, it typically doesn't bode well for the stock, especially when it is a pink-sheet, like MJNA, and especially when there is a history of exaggeration of positives, promises not delivered and important details not revealed. Recently, Creative Edge Nutrition (FITX) and Green Cures (GRCU) have seen their stocks suffer following vague announcements. With this deal specifically, investors should brace for massive dilution. Hopefully MJNA will share more detail before the closing, which is likely to be in Q2.

Comments

-

Please login first in order for you to submit comments